Joe Biden said on Monday that Congress should ‘immediately’ take action to forgive student loan debt through its next COVID relief package. His proposal would wipe out $10,000 of debt for ‘economically distressed’ students. It is one of the more modest plans being floated by a member of the Democratic party.

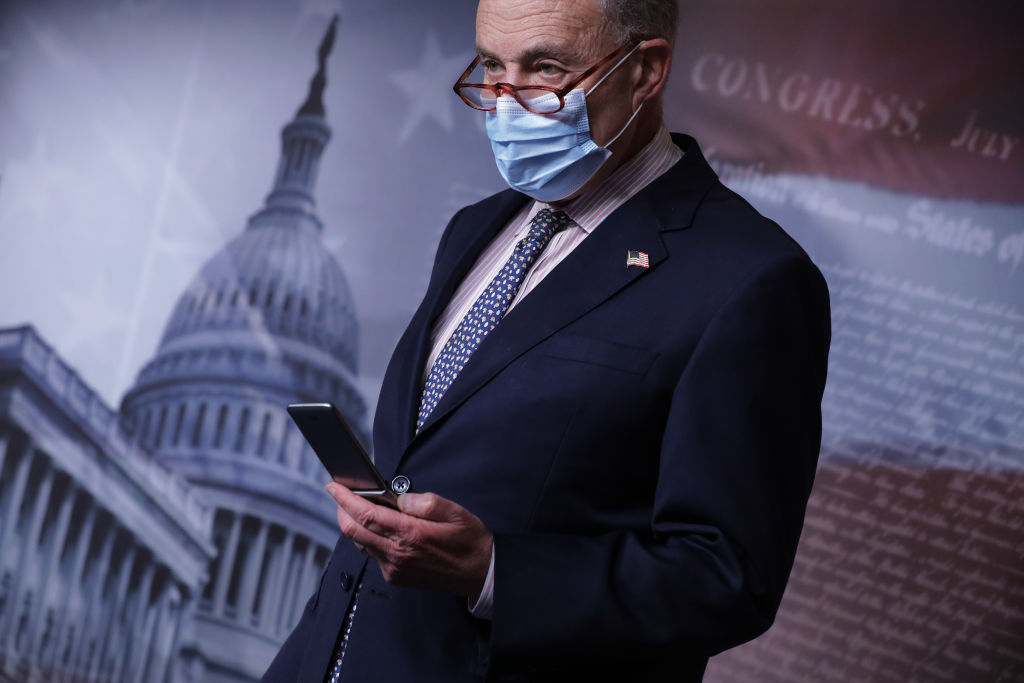

The plans of Biden’s more aggressive colleagues are largely just giveaways to universities and the most well-off students in attendance. Senate Minority Leader Chuck Schumer and Sen. Elizabeth Warren have authored a resolution calling for the next president to forgive $50,000 in debt per student borrower. Who benefits the most from such a plan? The rich. Federal Reserve data reveals that the highest-income 40 percent of households owe approximately 60 percent of outstanding student debt, while the lowest 40 percent owe just under 20 percent. This could be due to a combination of factors: students from high-income households are more likely to go expensive colleges, less likely to receive financial aid, and more likely to have high incomes post-graduation. Plus, the majority of student debt is held by graduate degree earners, who earn approximately 25 percent more than their undergraduate counterparts. Clearly, carte blanche student debt forgiveness is pretty regressive.

Even Biden’s broader student loan plan beyond COVID relief has some fundamental problems. He has recommended canceling student debt only for undergraduate degrees and for students making less than $125,000. This attempts to address the fact that Schumer and Warren’s plan largely helps out the wealthy, but is an incentive for universities to keep raising tuition and for students to choose to major in low-earning degree programs. Colleges have no reason to make their programs more affordable if they believe students will just take out more debt to keep covering the rising costs. And students will feel more comfortable making the irresponsible decision to go tens of thousands of dollars in debt to major in Women’s Studies or Drama if they know their loans will be forgiven.

[special_offer]

Biden’s idea of helping out low-income students who are struggling due to the pandemic is, on its face, more admirable than any of the aforementioned policy proposals. Still, he is providing adverse incentives for universities to jack up prices. That is especially concerning given the pandemic has rendered a college education practically worthless. Students are paying tens of thousands of dollars per year to live at home and be lectured via Zoom. Do we really want to tell colleges that they can get away with providing a subpar service for an exorbitant cost?

In the case of any of these student debt plans, working-class Americans who chose not to or could not afford to go to college will be subsidizing the education of the professional class. Plumbers and retail workers will be paying for the degrees of doctors and lawyers. Is this really the progressive ideal the Democratic party has tried to sell voters?